There are certain type of ‘Corrections’ on TDS / TCS Returns that may be done directly on TRACES web portal instead of going through filing of the ‘Correction Return’ These include ‘Adding Challan’ , ‘PAN’ and ‘Challan Corrections’.

Click on ‘TRACES Information > Add Challan / PAN / Challan Correction’

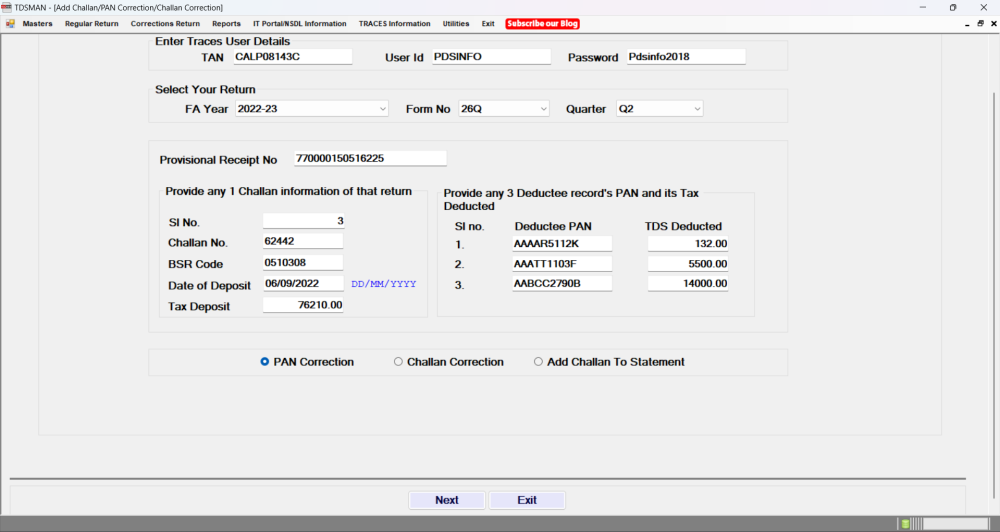

The following screen will get displayed:

Enter the TRACES login details.

Select the Return where corrections need to be made along with the ‘Provisional Receipt No.’ of the original Regular Return.

One will also need to provide relevant details of any one ‘Challan’ and any three ‘Deductee Record’. In case of the less than three in number, enter all Deductees.

Select any one ‘Correction Type’ and click on ‘Next’.

You will be directed to the relevant page on TRACES for making the corrections. Follow the instructions for the doing the needful.

Need more help with this?

TDSMAN - Support