For Correction Return, apart from Nullifying Deductees manually, it can also be done through any of these two different formats either Excel or CSV,. This would save effort in entering data through formats of the software interface.

Importing data from Excel / CSV can be done in 3 steps:

1. Export the desired record in the Excel or CSV sheet and store it in the system

2. Prepare the required data in that Excel or CSV sheet

3. Upload that data from the Excel/CSV sheet into the software

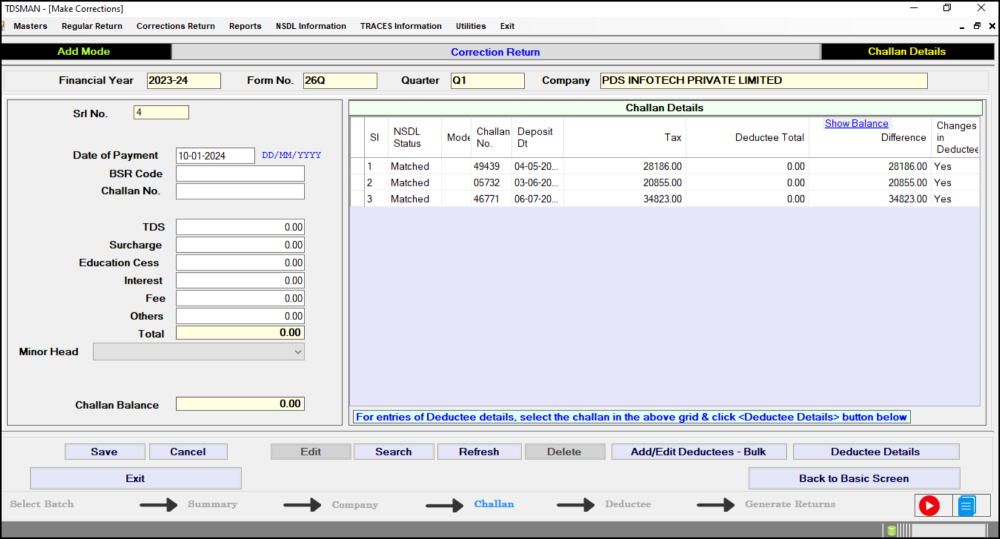

To import the data from Excel or CSV, Select the Correction Return that needs to be rectified. Select the Batch for which the Deductee details need to be nullified. The following screen will appear:

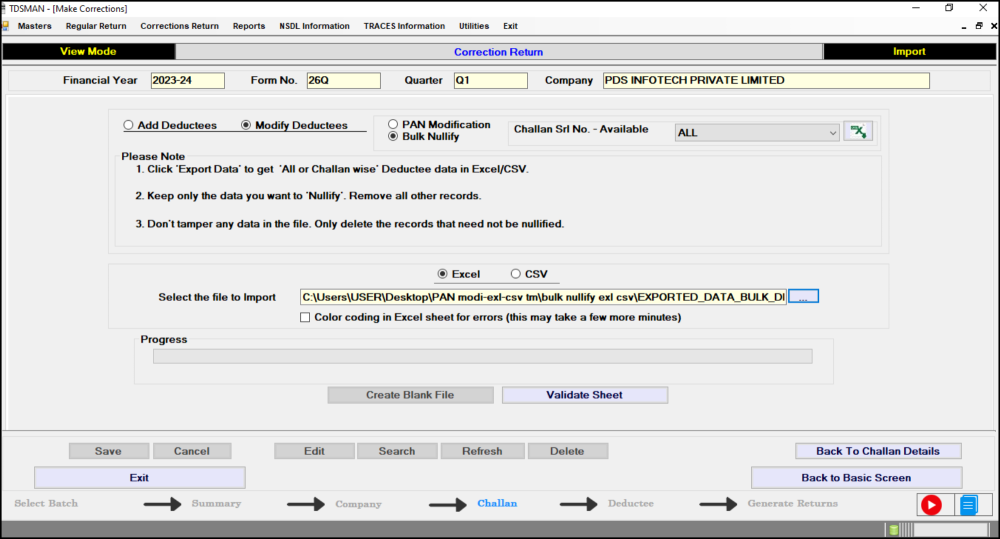

Now click on the “Add/Edit Deductee – Bulk” button. The following screen will appear:

First, click on “Modify Deductees”, then click on “Bulk Nullify”.

The system gives the following options:

• To nullify all the Challan deductees select “ALL” from the dropdown

• To nullify the deductees of the specified challan, select “the specified challan”

Select the desired option and click on the “Export Data for Bulk Nullify”

button to export the data to Excel file.

Further, we will be using the ‘Excel’ option to explain the operational procedures. However, the same can be similarly done through CSV format, by choosing the ‘CSV’ option. CSV is comparatively faster than Excel and also it is capable of handling larger volumes of data.

Prepare the data in this Excel sheet. Keep only those deductee records which need to be nullified. Remove all the other deductee records. Do not tamper any data in the Excel file.

Enter the Excel file path from which the data has to be imported.

Color coding in Excel Sheet for Errors – If there is any error in the data provided in the Excel sheet, the system will highlight the same. The user is expected to rectify the data and import the entire file again. However, in order to display these errors using the color code, check this box. (This option is not applicable for CSV)

Validate Excel File: Click on the “Validate Sheet” button. The system will validate the Excel data.

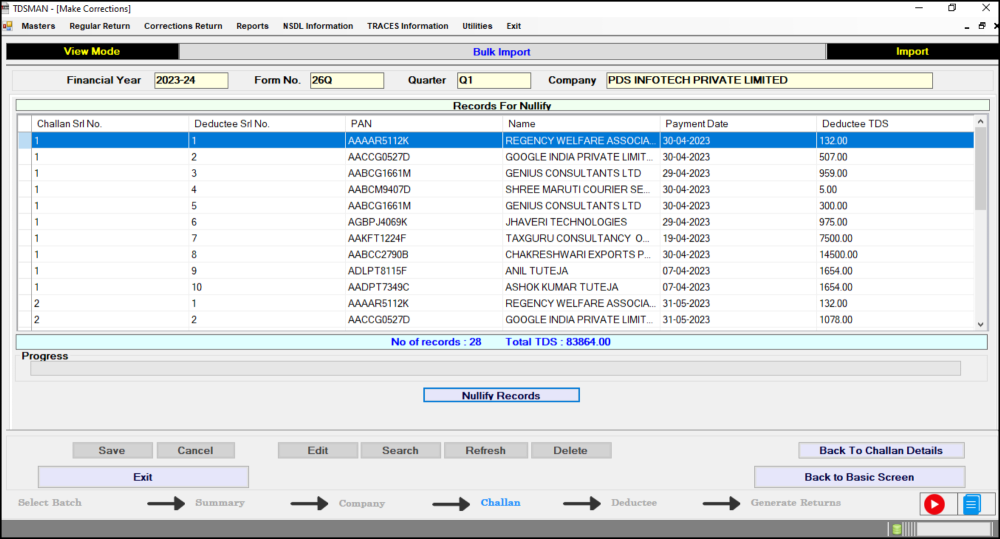

If the data is correct then the following screen will appear:

Click on the “Nullify Records” button. The data will nullified from the system.

In case, there is any error in the data, the system will highlight the errors. The errors have to be rectified and the Excel sheet has to be imported again.

Need more help with this?

TDSMAN - Support