After all data pertaining to the Return have been entered, one is now all set to generate the TDS / TCS Return.

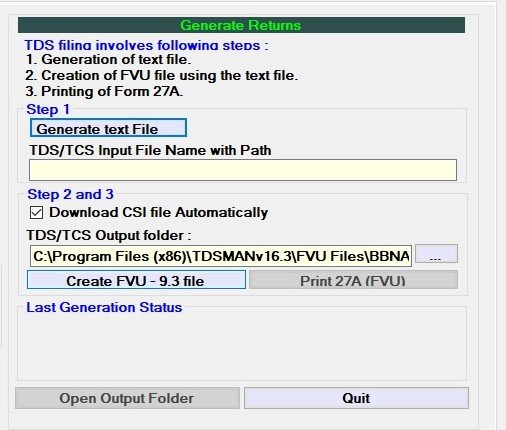

Click on ‘Generate Return’ from the Home Screen. The following interface appears on the right panel:

There are three steps involved in the Generation of Return as follows:

1. Generate the Text File

2. Challan Verification through CSI file

3. Generate FVU file using the FVU Utility of the Dept.

These steps are explained as under:

Generate the text file

In the first step you will have to generate the text file. This text file is used as an input file for the validation by the utility provided by Income Tax Department.

Challan Verification through CSI file

For verifying the Challans, the CSI file as provided by the Income Tax Dept. is required. This may either be downloaded automatically from their website or may be provided manually.

For ‘automatic’, the CSI will be downloaded either by ‘Password’ login (if opted for in the Company Master) or through ‘OTP’ login (Mobile No. and OTP as received will need to be entered). In the case of ‘manual’, the path of the CSI file needs to be provided.

Generate FVU file using the FVU Utility of the Dept.

The third step is the generation of the FVU file (Return for filing). This involves successful validation of the text file (Step #1) and Challan verification (Step #2). In case of validation failure, the FVU may not be generated or generated with errors.

If FVU is successfully generated, one can now file the Return either ‘Online’ or through ‘TIN-FC’ (print Form 27A for this option)

Need more help with this?

TDSMAN - Support