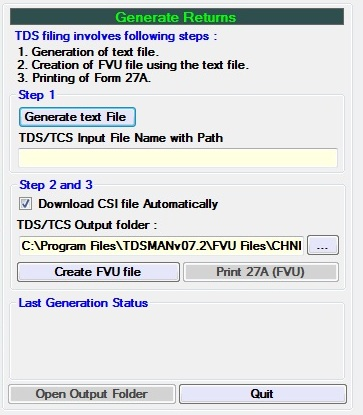

After all corrections have been done, you are all set to generate your Correction Return. Click on the ‘Generate Return’ and the following interface appears on the right panel:

Figure 7-9 Generate Correction Returns

Figure 7-9 Generate Correction ReturnsThere are 3 steps involved in the Generation of the correction returns.

i. Generate the text file

ii. Cross Verification of the challans

iii. Validation of the file generated using utility provided by IT department

Generate the text file

In the first step you will have to generate the text file. This text file is used as an input file for the validation by the utility provided by Income Tax Department.

Cross Verification of the challans

In second step you can check / uncheck Automatic CSI file download link for which Internet connection is prerequisite. This will download a file from the NSDL’s website which will have the Challan details as per IT records provided by the Bank/PAO for cross verification.

Validation of the file generated using utility provided by IT department

Third step involves validating the text file generated in Step 1 and generating the FVU file for submission. While validating, the Challan details entered in the returns and Challan Detail as uploaded by Bank will be cross verified. In case automatic CSI file is unchecked then the path of this file should be manually provided.

On validation, the status in terms of successful / unsuccessful validation will be displayed and one can also view the report for subsequent action.

After the return has been generated and validated, the return has to be submitted to TIN-FC or it can also be uploaded as per the rules in NSDL’s website. Steps for preparation for submission of the return are explained as under:

- Click on open output folder and copy the file having extension .fvu

- Print Form 27A by clicking on button ‘Print Form 27A’ which will also be required for submission of return along with the .fvu file in Floppy / CD / Pen drive.

Need more help with this?

TDSMAN - Support