The Income Tax Department has activated the online system to determine the ‘Specified Person’ on whom the higher rate of TDS / TCS will be applicable under the newly introduced Sections 206AB & 206CCA.

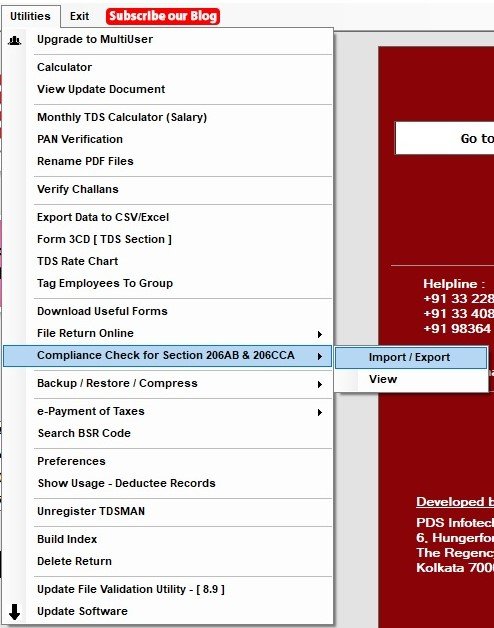

In order to do so click on ‘Utilities -> Compliance check for 206AB & 206CCA –> Import/Export’

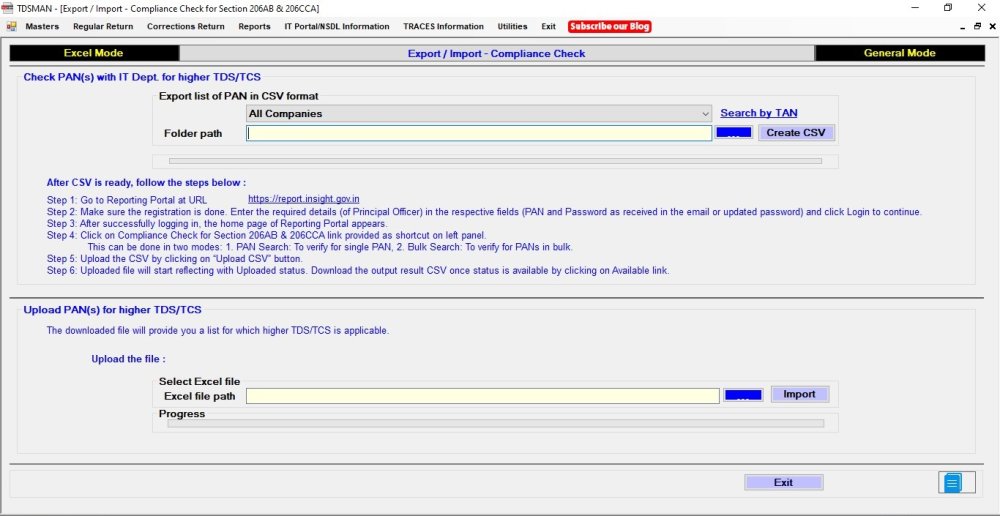

The Following screen will get displayed:

- Select a particular Company or All companies for which the PAN has to be verified.

- Create the CSV file of a list of PANs (maximum 10,000 at a time) by clicking on ‘Create CSV’

- Upload this CSV on the Income Tax portal (The link is provided)

- This will get verified by the Income Tax Department

- After a short while, the output CSV can be downloaded with response for each PAN

- Now Import this file in the TDSMAN software by clicking on ‘Import’

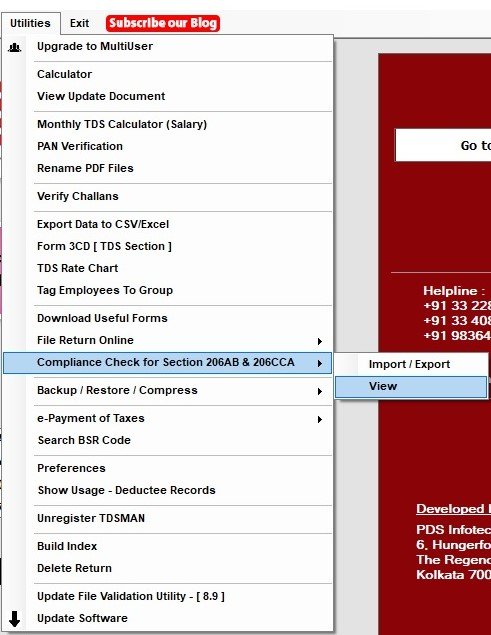

Now, in order to view this file click on ‘Utilities -> Compliance check for 206AB & 206CCA –> View’

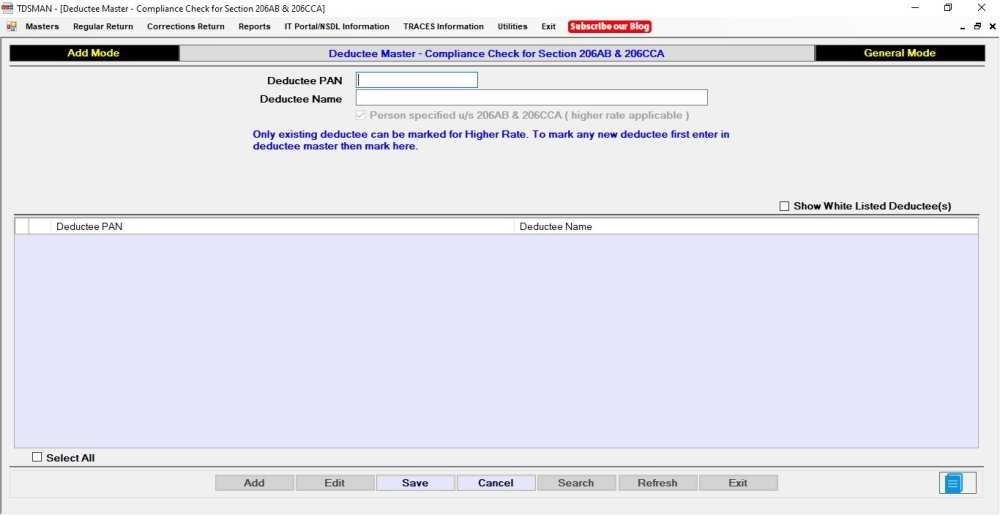

The Following screen will get displayed:

The complete list of updated PAN will get displayed.

All the PANs with higher rates have to be marked and saved so that the information gets updated in the database.

Now , at the time of TDS calculation this higher rate will be considered by default .

Need more help with this?

TDSMAN - Support