While placing or importing data in Annexure II (Salary Details) in Form 24Q, the user also enters the ‘Tax Payable’ value for each employee. On the interface of Annexure II, for each employee record, one can cross-check the entered ‘Tax Payable’ value with the system computed value and accordingly, if required correction action can be taken.

Through this module, one can do bulk cross-check of system computed values with the values provided.

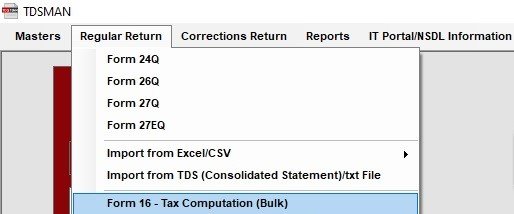

Click on ‘Regular Return > Form 16 – Tax Computation (Bulk)’

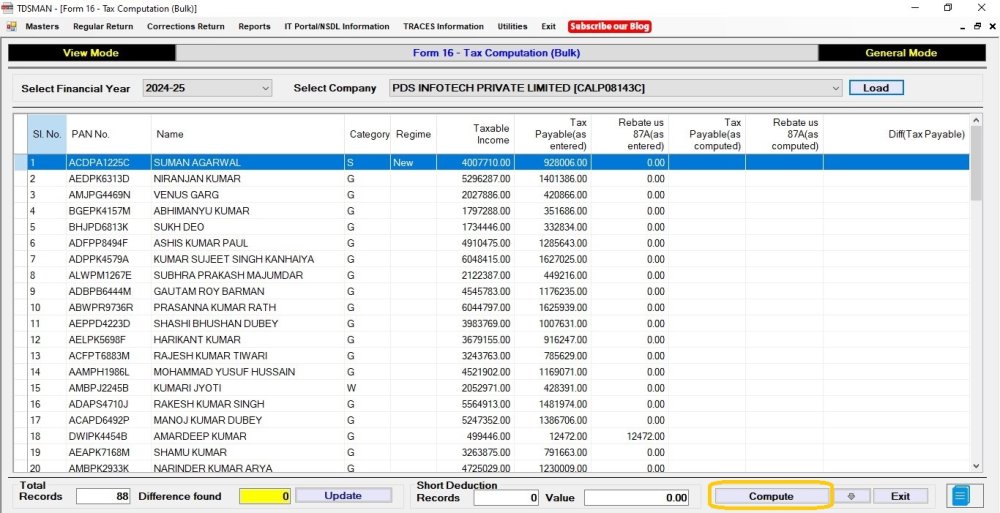

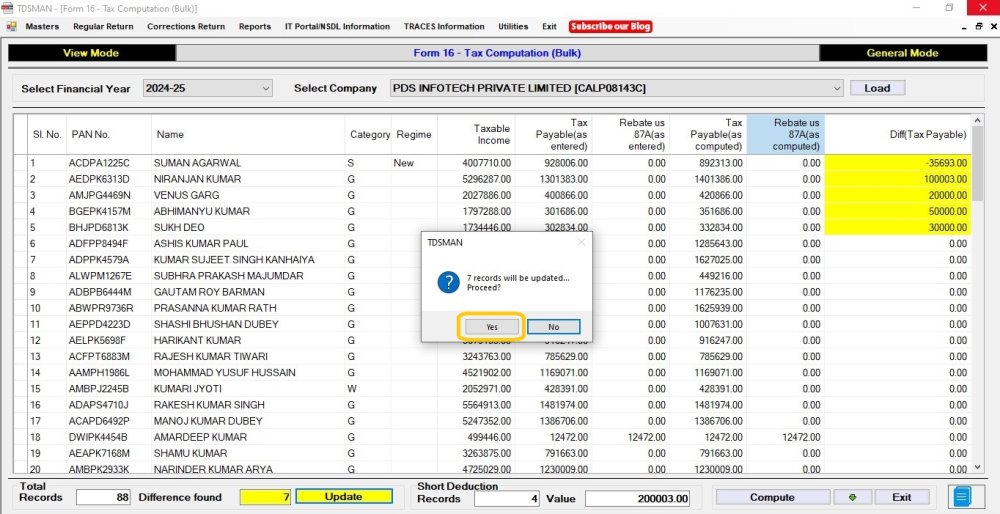

Select the Financial Year and Company. Click on ‘Load’ to get all the employee records as per Annexure II on the grid below:

The data as appearing on the grid displays the employee records with the ‘Tax Payable’ as entered.

Click on ’Compute’ for determining the system calculated ‘Tax Payable’.

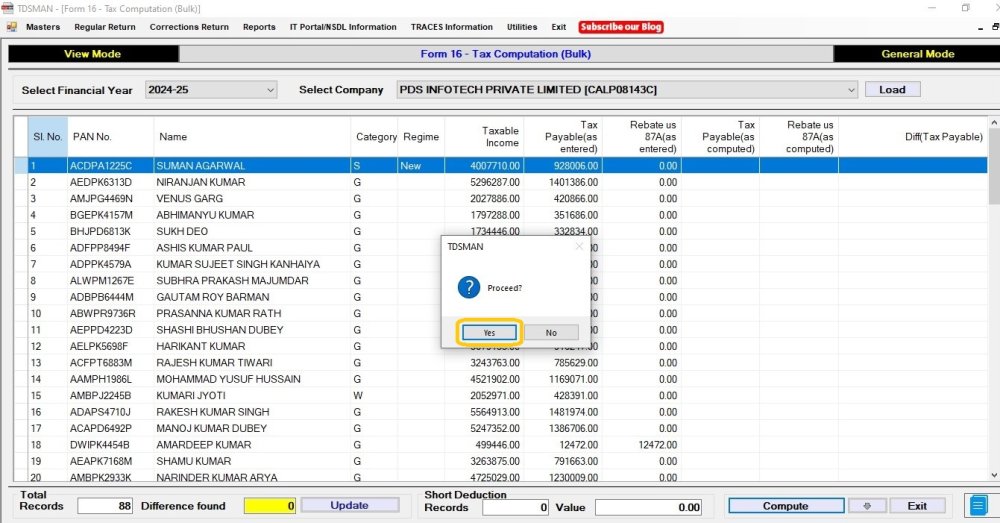

Click on ‘Yes’

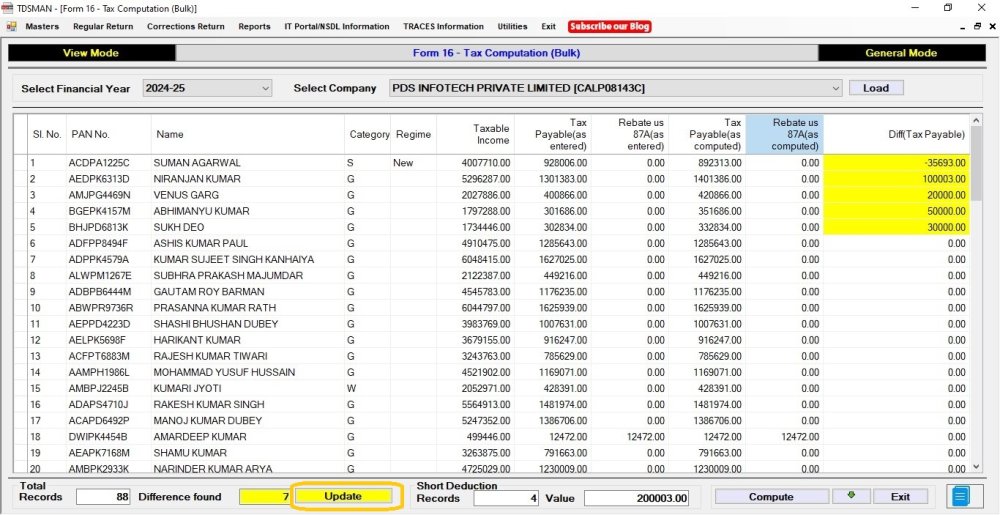

The result will be displayed as under:

Both the values are now displayed alongside with the difference, if any. The relevant summary is provided at the bottom of the grid. To download this data in ‘Excel’, click on the

Update :

The user has the option to update the database and replace the current data with the corrected data.

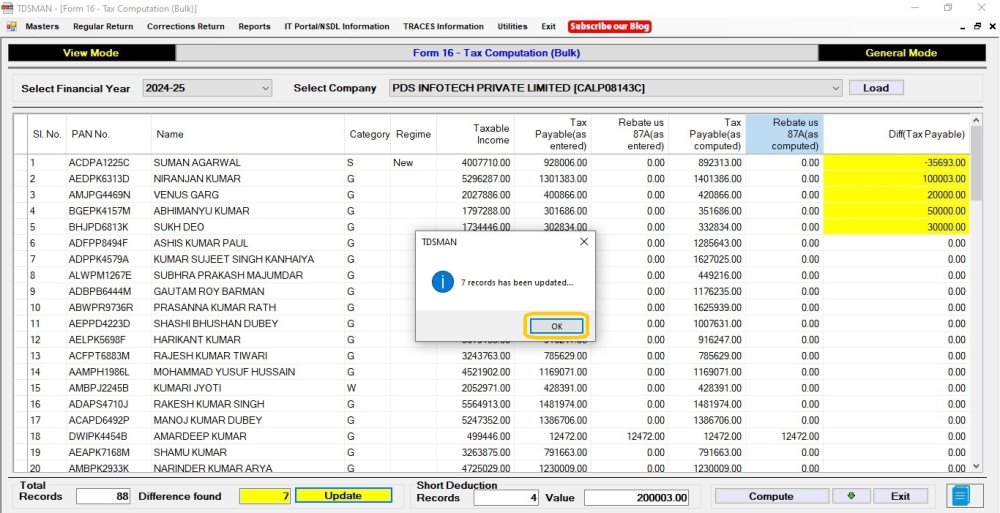

In order to do this click on ‘Update’.Click on ‘Yes’

Records will automatically updated ,

Click on ‘Ok’

Need more help with this?

TDSMAN - Support