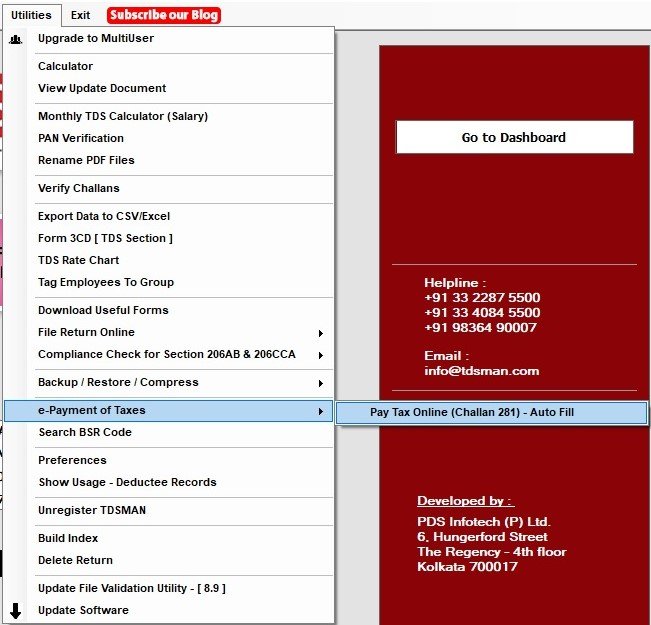

The e-Payment of Taxes is done online through the Income Tax Portal. We have integrated the IT Portal screens directly from the software. Click on ‘Utilities > e-Payment of Taxes’

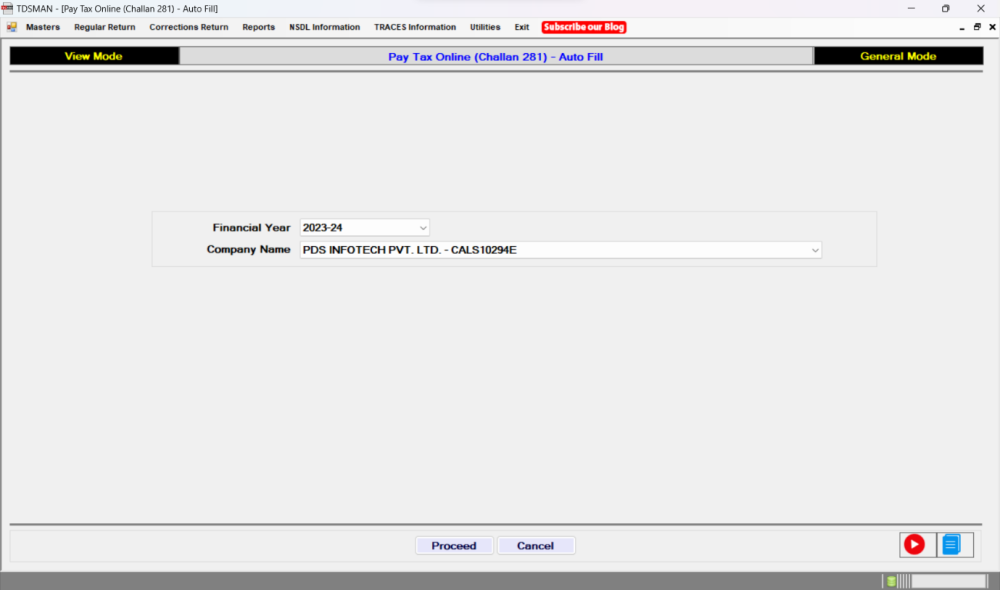

The following screen will get displayed:

Enter the Financial Year and the Company Name and click on ‘Proceed’.

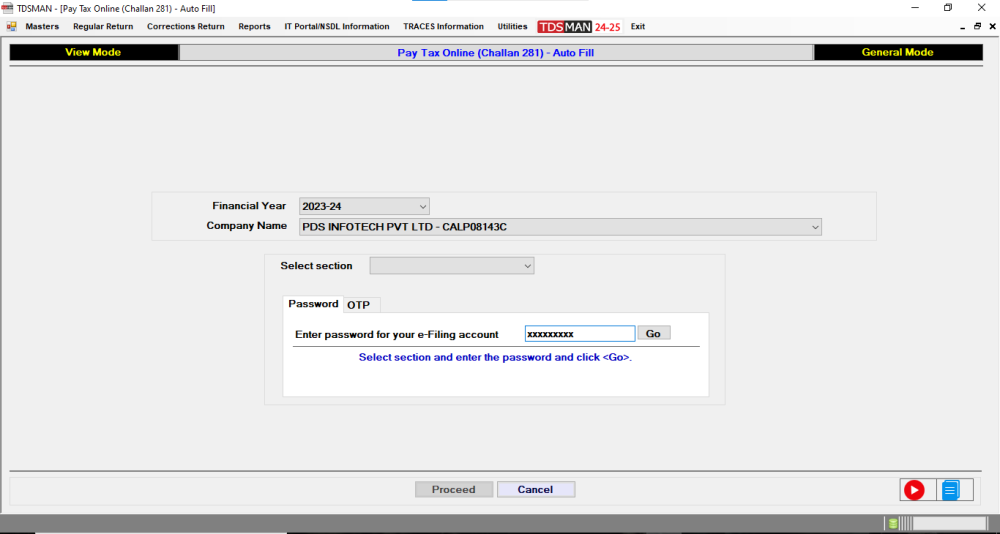

The following interface will appear as under:

Select the Section (as it is required by the IT Department, although it does not have relevance)

To access the e-Payment on the Income Tax Portal, either one has to log in through the Password or OTP which can be selected accordingly.

For OTP, provide the Mobile No. to receive the OTP and enter the same.

Click on ‘Go’ to open the relevant page on the Income Tax Portal for making the e-Payment.

Need more help with this?

TDSMAN - Support