Purpose

This report is used to generate the details of all the records that have been submitted in a particular return. The user has to select the specific parameter son the basis of which the report will be generated.

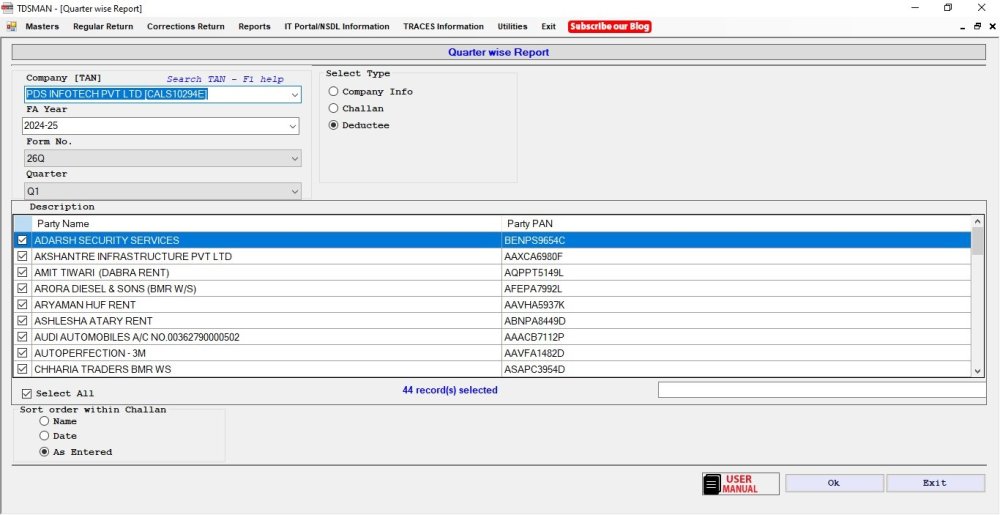

In order to view this report, click on Reports > Quarter Wise Reports :-

The following screen will appear :

Selections

Deductor (Company) : Select the Deductor/Company for which the report has to be generated.

Financial Year : Select the Financial Year for which the report has to be generated.

Quarter No. : Select the Quarter No. for which the report has to be generated.

Form No. : Select the Form No. for which the report has to be generated.

Select Type

On the basis of the criteria provided, ‘Select Type’ gives the user the option of generating three different sections of this return. The different sections are:

a. Company Info

b. Challan

c. Deductee/Employee

Each section is explained below.

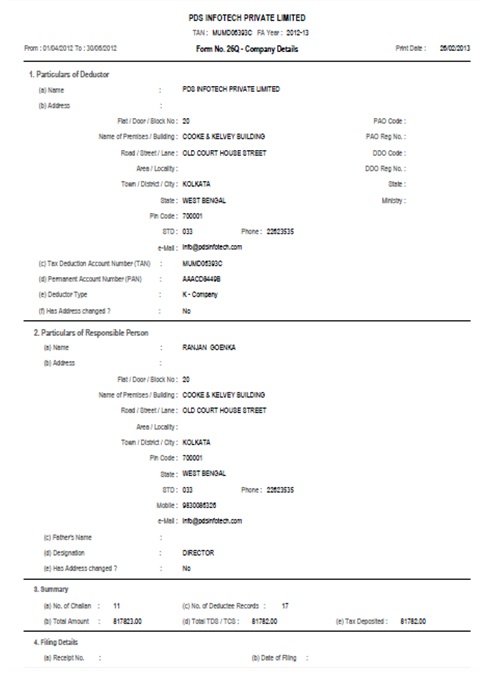

a. Company info

This report provides the details of the company entered in the return. It also provides the summarized information of the challans and deductees submitted.

Figure 6-1 Report on Company Information

Figure 6-1 Report on Company Informationb. Challan

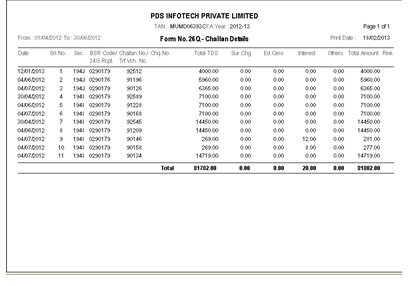

This report provides the details of all the challans for the selected return. It can be sorted on the

basis of the date, section or the way it has been entered.

Figure 6-2 Report on Challan Details

Figure 6-2 Report on Challan Detailsc. Deductee

This report provides the details of all the deductee within the challans. The deductees can be

sorted on deductee name, date or as entered, within the challan.

Need more help with this?

TDSMAN - Support