Once the TDS Return is successfully filed, an acknowledgement receipt is provided. Information on the receipt is important for filling the next Return and should be stored in the system.

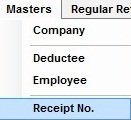

To enter the receipt details, click on Masters > Receipt No :-

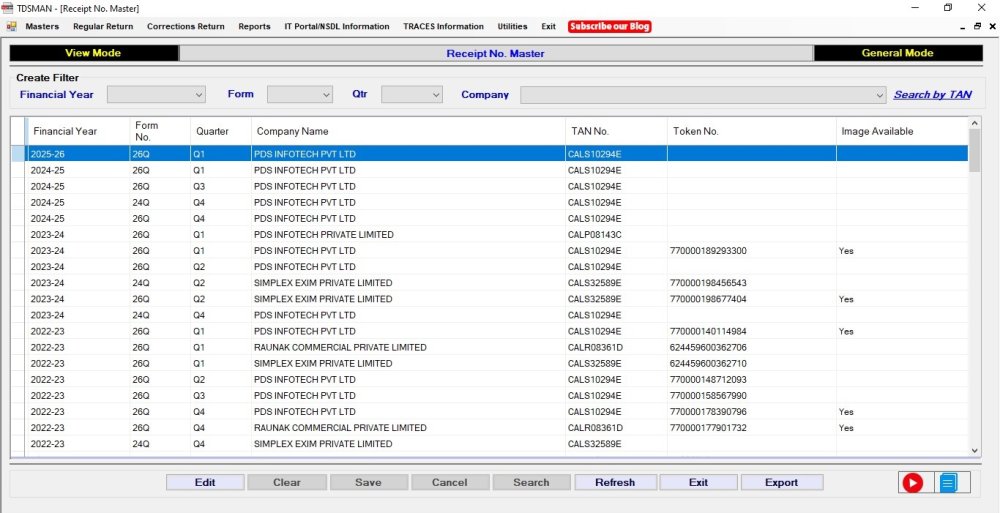

The following screen will appear:

Financial Year: Select the Financial Year of the Return for which the Receipt details have to be entered.

Form No: Select the Form No. of the Return for which the Receipt details have to be entered.

Quarter: Select the Quarter of the Return for which the Receipt details have to be entered.

Company Name: Select the Company Name of the Return for which the Receipt details have to be entered.

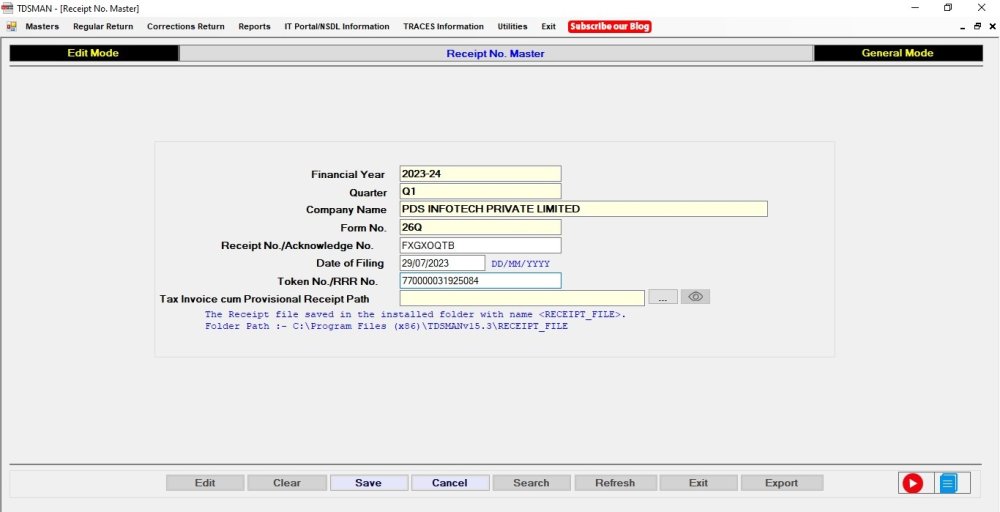

Click on Edit. The following screen will appear:

Receipt No. : Enter the Receipt Number.

Date of Filing : Enter the Date of Filing.

Token No. : Enter the Token No.

Tax Invoice Cum Provisional Receipt Path: It is optional to provide Receipt path.

Need more help with this?

TDSMAN - Support