To file the return you will have to select a particular form under which the return will be prepared. Basically there are four forms that can be selected. These four Forms are explained in section 4.1

There are three broad steps required for the preparation of the file for returns. They are as following:

i. Selection of Parameters for filing the Returns

ii. Challan and Deductee Entry

iii. Generation of Returns

We shall discuss in details about all the steps mentioned above, over the subsequent sections.

As Form 26Qis most popularly used, the same is being used to explain the operational procedure.

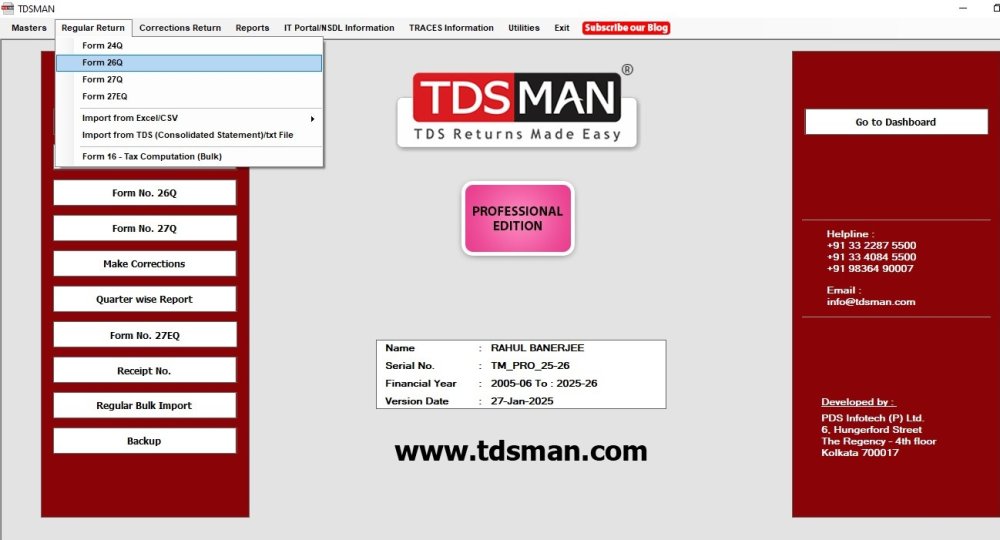

In order to select Form 26Q, click Form 26Q under Regular Return option as shown below:

Form 26Q can also be selected by clicking on shortcut button

Need more help with this?

TDSMAN - Support