After the TDS / TCS Return is filed, one can request for Certificates at TRACES. Subsequently, these will be made available at TRACES for download.

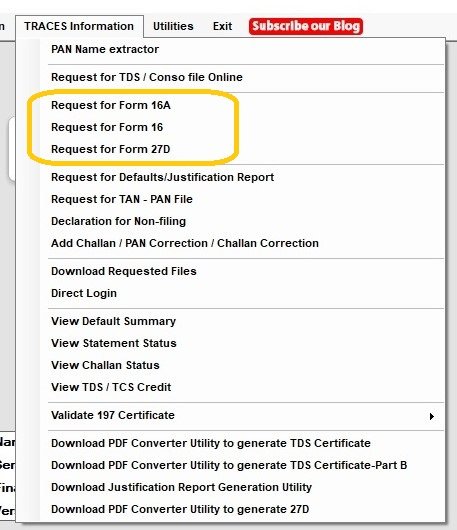

For each of the TDS / TCS Certificates, i.e. Form 16A (Non-Salary), Form 16 (Salary) & Form 27D (TCS) – the procedure to request at TRACES is explained below:

Click on TRACES Information > Request for Form 16 or Form 16A or Form 27D (as the case may be).

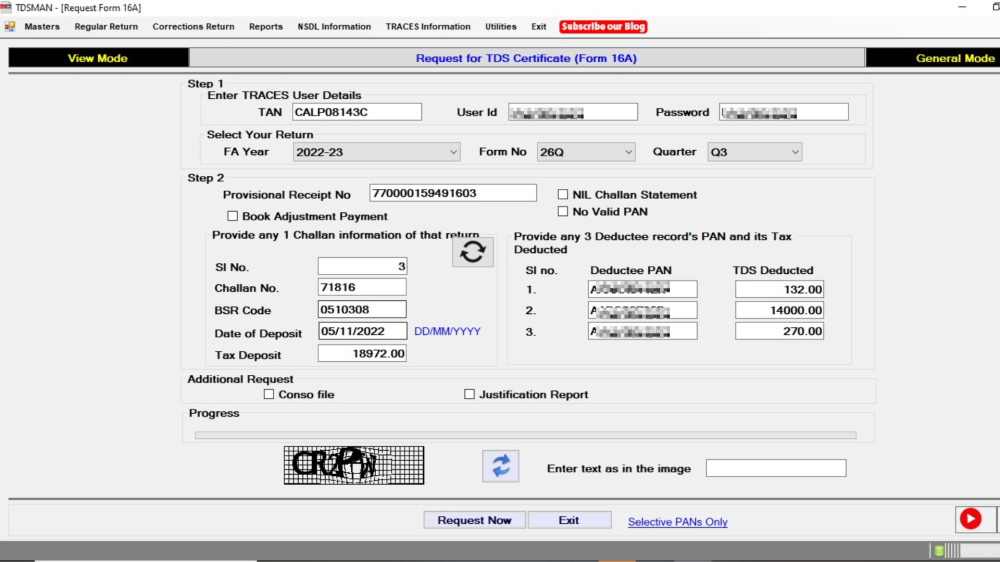

The following screen will get displayed:

Enter the TRACES login details.

Select the Return where corrections need to be made along with the ‘Provisional Receipt No.’ of the original Regular Return.

One will also need to provide relevant details of any one ‘Challan’ and any three ‘Deductee Record’. In case of the less than three in number, enter all Deductees.

Enter the ‘Captcha’ and click on ‘Request’.

On successful submission, TRACES generates a number which is displayed. Once it is ready, one can download it from the menu option ‘Download Requested File’.

Note: This request is for all PANs within the selected Return. One may request only for selective PANs by clicking on ‘Selective PANs Only’ followed by selecting the PANs.

Need more help with this?

TDSMAN - Support